In Depth: The Rectification and Remaking of Ant Group

The days when a Chinese consumer could use their Alipay app as a one-stop shop to do everything from buying groceries and train tickets to taking out a loan and investing in a mutual fund appear to be numbered as the government takes aim at fintech giants over monopoly behavior, risky lending practices and data privacy.

That might be bad news for its 711 million monthly active users, who will no longer have the convenience of borrowing money or buying wealth management products with a couple of taps on their smartphone, but it could be even worse news for Ant Group Co. Ltd., the owner of Alipay, which is being forced to remove its biggest money-earners, the Huabei (花呗) and Jiebei (借呗) lending products, from its ubiquitous payments platform on the orders of China’s regulators.

The delinking of the lending products is part of a comprehensive overhaul of Ant Group’s business demanded by regulators who scuppered what would have been the world-record-breaking $34.5 billion IPO in November 2020. Now, after six months of talks with financial regulators, a roadmap has emerged that will hopefully put billionaire Jack Ma’s fintech behemoth back on track.

Ant Group and the financial authorities have agreed on a wide-ranging rectification plan that may become a template for its peers to follow as policymakers pursue a multi-faceted campaign. On the one hand, the authorities want to champion consumer rights and privacy, and on the other fight corporate monopolies, tamp down financial risks and level the regulatory playing field between upstart innovative fintech groups and the more staid, traditional financial institutions that have been left behind in the financial revolution of the last decade.

Most of the talking about the rectification has been done by the four financial regulators including the People’s Bank of China (PBOC). Ant Group put out a brief statement about the changes in an April 12 statement after its third summons to meet with the PBOC and other financial regulators, but it has not issued any further information.

Although Ant Group was the main target of the regulatory action, other integrated fintech companies such as Tencent Holdings Ltd.’s Tenpay Payment Technology Co. Ltd. that operates the WeChat Pay payment platform, JD Technology, part of e-commerce giant JD.com Inc., and Du Xiaoman Financial, a fintech spin-off from internet search giant Baidu Inc., will all be affected by the swathe of new regulations that have descended like a tsunami on the fintech sector over the past year.

The issues identified at Ant Group are not only specific to the company but are “universal,” the China Banking and Insurance Regulatory Commission (CBIRC) said in a Q&A (link in Chinese) on its website on Dec. 31. “The rapid development of financial digitalization has given rise to issues related to cybersecurity, market monopoly, unclear data ownership, and consumer rights protection, which have affected market fairness and financial stability… Problems exist when some internet platforms carry out online microlending business, such as unsound corporate governance, profiteering from data monopolies, and the encouragement of excessive borrowing and leveraging.”

What regulators want

Here’s what we know about Ant Group’s plan so far. There are five main aspects to the rectification:

* Restructuring the group into a financial holding company (FHC) that will incorporate all the subsidiaries engaged in financial activities and be subject to the regulations on such entities released by the State Council and the PBOC in September 2020.

* Addressing unfair competition practices in the payments business. This will involve stripping the Alipay third-party payments platform back to its origins as a payment services provider, removing Ant Group’s financial products including Huabei and Jiebei from the platform and delinking them from the Alipay payments infrastructure.

* Consolidating lending operations. This will involve putting all the group’s lending businesses into Chongqing Ant Consumer Finance Co. Ltd. (CACF), which is 50% owned by Ant Group. The company already has a consumer finance license although it hasn’t yet started operating. Huabei and Jiebei, currently run by two Ant Group microlending companies registered in Chongqing city and regulated by the local government, will be incorporated into the consumer finance company that will be regulated by the CBIRC.

* Overhauling the personal credit reporting business. This will involve setting up a company that will apply for a personal credit reporting license and be subject to the PBOC’s upcoming “Measures for the Management of the Credit Reporting Business.”

* Ensuring compliance with financial watchdogs’ prudential regulatory framework, improving corporate governance and rectifying illegal financial activities to control excessive leverage and the risk of contagion.

* Managing and controlling liquidity risks for fund products and reducing the size of Yu’e Bao, China’s biggest money-market fund platform chiefly run by Tianhong Asset Management Co. Ltd., which is 51% owned by Ant Group.

Read more

PBOC Q&A: What Regulators Want From Ant Group

The regulators haven’t publicly announced any specific deadlines for Ant Group to complete the rectification, some of which is likely to take months if not years to carry out.

Implications for Ant Group

Ant Group’s plan to turn itself into an FHC is likely to be a significant constraint on its business operations and its growth owing to the stricter capital requirements it will need to meet. Under new rules that went into effect on Nov. 1, 2020, all FHCs will need to have paid-in capital of at least 50% of the total registered capital of all the financial institutions they control and have the ability to replenish their capital as needed. The aim of these tough requirements is to prevent the kind of reckless and uncontrolled leverage taken on by shady financial conglomerates such as Anbang Insurance Group Co. Ltd. and Tomorrow Holding Co. Ltd. that threatened the stability of the banking system.

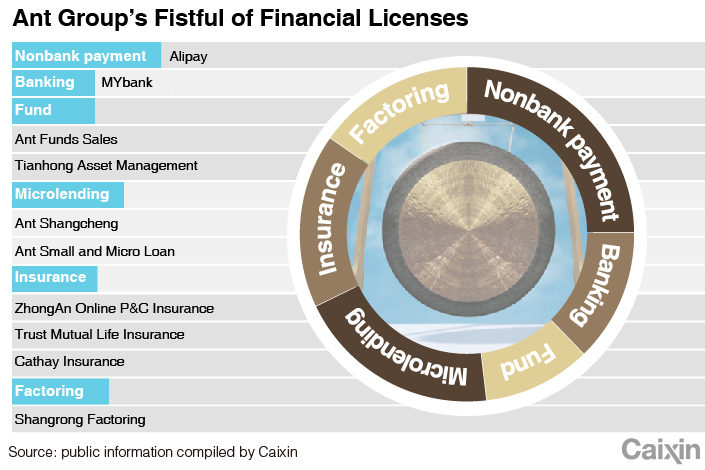

The FHC will include all of the units engaged in financial activities, including subsidiaries holding a wide variety of financial licenses covering areas such as banking, fund management, insurance, third-party payments, online microlending and consumer finance. Their combined registered capital will be around 77 billion yuan ($11.9 billion), according to Caixin calculations, which means Ant Group will need a minimum of 38.5 billion yuan in paid-in registered capital, a 62% increase from the current level of 23.8 billion yuan. As a result, the FHC will need a capital infusion of 15 billion yuan just to maintain its operations at their current level and would need to add even more to sustain its growth.

|

“The requirements are quite high and will limit the capital leverage of financial holding companies,” Zeng Gang, a deputy director of the National Institution for Finance and Development, told Caixin (link in Chinese). “In the past, it didn’t matter how high the leverage of these financial conglomerates’ subsidiaries was as there were no capital constraints, but it will be different in future… With the financial statements of the subsidiaries needing to be consolidated, their (FHC’s) risk assets must match their capital due to the potential spillover effects of financial risks.”

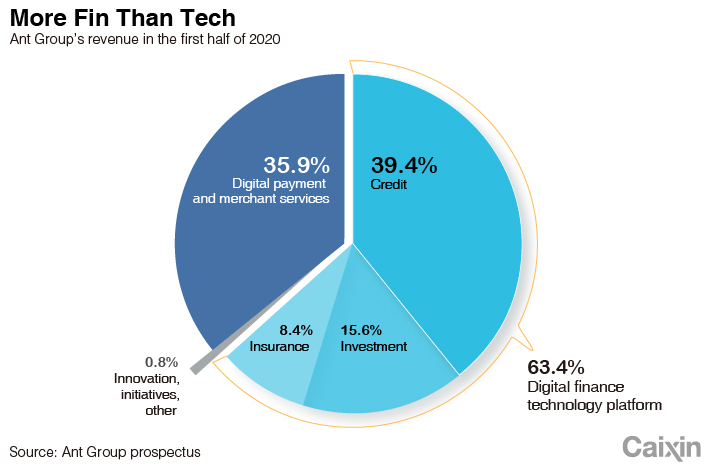

Ant Group is the biggest online consumer credit platform in China through Huabei and Jiebei, which offer unsecured loans. Online lending was the single biggest contributor to Ant Group’s revenue in the first half of 2020, accounting for nearly 40% of the total. Online credit services reported revenue grew 59.5% year on year to 28.6 billion yuan during the period.

|

Removing these products from Alipay’s ecosystem is likely, at least in the short term, to hobble the expansion of what’s been a lucrative business and potentially open the door for competitors to take some of its market share.

“We expect the delinking of Ant’s payment and microloan business to weaken its competitive advantage of cross-selling through its Alipay platform, allowing consumers more choice over their payment platforms or OM (online microlending) providers,” Fitch Ratings said in an April 22 report. “This, coupled with the effects of other recent regulatory action, may moderate Ant’s revenue and profit growth in the near term.”

The rectification plan requires all of Ant Group’s lending operations to be incorporated into CACF. Its license will allow it to offer small consumer loans nationwide, with leverage of up to 10 times, a higher amount than allowed in the small-scale consumer lending licences offered by regional governments, according to Fitch Ratings.

CACF will face tougher restrictions in other aspects of the business following new rules on online lending and joint lending issued on Feb. 19, which require a nonbank institution to provide at least 30% of the capital in any online joint loan with a bank. It will also be subject to a capital adequacy ratio (link in Chinese) of no less than 10%, under regulations for consumer finance companies.

As a result, CACF’s registered capital would potentially need to rise by nearly 580% to at least 54 billion yuan from the current 8 billion yuan to offer the current amount of 1.8 trillion yuan in outstanding joint loans in compliance with regulations, compared with the combined 16 billion yuan in registered capital of the two microlending companies currently operating Huabei and Jiebei, according to Caixin calculations.

The growth and scale of Ant Group’s credit business will be constrained by capital requirements in the long run, analysts with Zhongtai Securities Co. Ltd. wrote in a report (link in Chinese) released on April 1. Its business model may shift away from financial exposure to joint lending to focus on providing traditional financial institutions with the services related to such lending including credit reporting and data technology services for risk management, the analysts wrote.

As China’s biggest third-party payments provider and microlender, Ant Group built up a massive proprietary database of credit information on millions of individuals and small businesses. It also offers fraud prevention and risk management services and assesses borrowers’ creditworthiness for banks.

One of regulators’ main gripes against Ant Group was that it has been slow to feed its data to Baihang Credit Scoring (BCS), a central-bank backed company set up in 2018 to collect information on companies and individuals from lending channels outside the traditional financial system. Financial authorities were also concerned about the industry in general and the growing abuse of the collection, storage and sale of information on individuals and companies and in January, the PBOC released a draft of proposed regulations on credit reporting aimed at stepping up supervision of the industry.

Read more

Four Things to Know About China’s Big Changes to Data Collection Rules

Ant Group’s rectification plan indicates regulators have finally got what they want. In its April 12 statement, the company pledged to “conduct the personal credit reporting business in compliance with relevant laws and regulations, strengthen the protection of personal information, and effectively prevent the abuse of data.” But it appears that Ant Group will get something in return — a coveted personal credit reporting license of its own. The statement said it would set up a personal credit reporting company and apply for a license, and it’s unlikely to have made that public without some assurance of success.

If and when the approval comes, Ant Group will become only the third company to win a personal credit reporting license, following BCS and Pudao Credit, which obtained a license in 2020 and started operating in February. Although Ant Group has an 8% shareholding in BCS and Pudao has several shareholders, it will have sole ownership of the new personal credit company and operate it independently, multiple sources told Caixin.

Most analysts agree that the rectification plan will negatively affect Ant Group’s valuation if and when it resurrects its IPO. Bloomberg Intelligence senior analyst Francis Chan said in a recent report he expects the valuation to drop below 700 billion yuan from 2.1 trillion yuan when it attempted to go public in November.

Read more

What You Need to Know About Ant Group’s Suspended IPO and the Future of Chinese Fintech

The dramatic change in the regulatory environment is also spreading to other fintech companies. JD Technology has withdrawn its application for an IPO on Shanghai’s Nasdaq-style STAR Market, the bourse announced on April 2. The company is also planning to set up an FHC.

“The tightening regulation on the financial businesses of fintech companies will have an impact on their capital replenishment, and even their listing review and valuation,” an investment banker who did not want to be identified told Caixin (link in Chinese).

The CBIRC and the PBOC have made it clear that the problems they aim to address through Ant Group’s rectification plan aren’t unique to the company, and the stream of regulations rolled out over the past year demonstrate that all players in the fintech sector will have to step into line.

The plan looks set to mark the end of a model where companies used the digital payment function on their platforms as a port of entry to attract users into more lucrative areas such as consumer lending. A source close to the central bank told Caixin that other platforms will be required to rectify similar practices. This will include JD Technology’s online consumer loan product JD Baitiao and the online microlending service offered by Chinese food-delivery giant Meituan.

New regulatory requirements will also significantly increase compliance costs for fintech companies, Ji Shaofeng, an internet finance and microlending expert, wrote in a recent opinion piece (link in Chinese).

“China’s fintech industry participants will have to adjust to tighter regulations that will have a broader and stronger oversight, leading to a period of moderating fintech growth and investment in the sector,” Yan Li, an analyst with Moody’s Investors Service, said in a March report. The new regulations and rules will bring risks for fintech companies “as the tightened regulatory environment would require significant changes to the business models of their financial services businesses.”

Lin Jinbing contributed to this report.

Reference: The Regulations Ant Group Has to Wrestle With

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新