Caixin Explains: Why and How China’s Overhauling Monetary Policy (Part 3)

Listen to the full version

China’s central bank has started a major overhaul of how it manages monetary policy as the country adapts to slowing growth and the changing structure of the economy.

The new framework, which brings the People’s Bank of China (PBOC) more into line with its peers in other major economies including the U.S. and European Union, was flagged by Governor Pan Gongsheng in a speech in June. He also pledged to improve communication with the markets to enhance transparency and guide expectations about the direction of policy.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- The People's Bank of China (PBOC) is overhauling its monetary policy framework, focusing on interest rates rather than quantitative targets.

- Changes include adopting a single main policy rate, trading government bonds in the secondary market, and improving market communication.

- The PBOC faces challenges in maintaining a normal yield curve with its limited holdings of Chinese government bonds and needs innovative tools to manage liquidity effectively.

China's central bank, the People's Bank of China (PBOC), is undergoing significant changes in its monetary policy management to align more closely with other major economies like the U.S. and the European Union. This transformation has been highlighted by Pan Gongsheng, the Governor of PBOC, who emphasized better market communication to enhance transparency and clearly direct policy expectations [para. 1][para. 2].

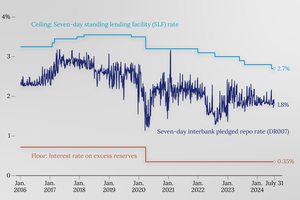

The reform includes three primary adjustments: moving away from quantitative targets to focus more on interest rates, simplifying the currently complex interest rate system possibly down to a single main policy rate, and introducing government bond trading in the secondary market as a new instrument for managing liquidity [para. 3]. Previously, the PBOC abstained from trading in the secondary market due to insufficient holdings of Chinese government bonds (CGBs) to influence the market significantly, but recent directives and market developments have changed this [para. 5][para. 7][para. 9].

This strategy aims to stabilize the main policy rate, the seven-day reverse repo rate, by controlling the base money supply, which includes commercial bank reserves and general currency circulation. To manage the short-term liquidity, PBOC employed daily open market operations (OMOs) and medium-term lending facilities (MLF) for longer-term adjustments [para. 5][para. 21]. Trading CGBs in the secondary market gives the central bank more flexibility to regulate liquidity beyond short- and medium-term loans, helping manage both liquidity and interest rate expectations [para. 21][para. 22].

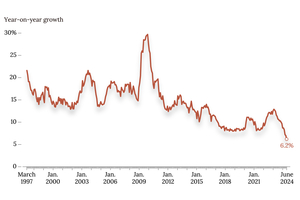

By trading CGBs, the central bank can manipulate the yield curve, which represents borrowing costs over different periods and reflects future interest rate expectations. The goal is to ensure a "normal yield curve," where longer maturities yield higher returns, countering any abnormalities caused by market conditions like the bond bull run observed this year [para. 24][para. 25]. The PBOC initiated this by swapping short-term bonds for long-term ones, making a significant net purchase to influence long-term yields [para. 27].

Challenges remain regarding the adequacy of the PBOC's bond supply for effective management. Currently, it holds only 1.52 trillion yuan of CGBs, less than 5% of all outstanding CGBs, which analysts deem insufficient for substantial market influence. To overcome this, the PBOC plans to borrow bonds from primary dealers and diversify its tools for bond trading [para. 28][para. 29][para. 30]. Coordination with the Ministry of Finance on the issuance of varied maturity bonds is also crucial, with plans already set for a multi-year issuance of special treasury bonds [para. 31].

Communication and transparency are critical for the success of these policies. Governor Pan has stressed the need for clear and timely communication about policy decisions to market participants to stabilize expectations and enhance policy effectiveness [para. 36]. However, direct trading of government bonds can send mixed signals about monetary policy, adding complexity to the central bank's communication strategy [para. 34][para. 35].

In conclusion, the PBOC's overhaul aims at refining the interest rate system, stabilizing the main policy rate through expanded liquidity management tools, and enhancing market communication to ensure policy transparency and manage future expectations effectively [para. 38][para. 39][para. 40].

- October 2023:

- President Xi Jinping made comments at the twice-a-decade Central Financial Work Conference about enriching the monetary policy toolkit, including gradually increasing the buying and selling of government bonds in open market operations.

- March 2024:

- A book of President Xi Jinping’s speeches was published containing his October 2023 comments.

- March 2024:

- Premier Li Qiang announced a multi-year program of ultra-long special treasury bond issuance and set the 2024 quota at 1 trillion yuan.

- May 2024:

- The Ministry of Finance published a timetable of sales for 2024, including 20-year, 30-year, and 50-year Chinese government bonds (CGBs).

- May 2024:

- Zhang Tao wrote a commentary in Caixin discussing the potential complex policy signals of direct government bond trading by the central bank.

- June 2024:

- Governor Pan Gongsheng flagged the overhaul of the PBOC’s monetary policy in a speech, including three key changes: shifting away from quantitative targets toward interest rates, refining the interest rate system, and trading government bonds in the secondary market.

- June 2024:

- Governor Pan Gongsheng announced that the time is right to use CGBs to adjust the quantity of money in the financial system through open market operations (OMOs).

- Early July 2024:

- The PBOC confirmed that it had signed agreements to borrow hundreds of billions of yuan of medium- and long-term CGBs from financial institutions.

- By the end of July 2024:

- The central bank held around 1.52 trillion yuan of CGBs.

- August 2024:

- The PBOC made its first move to trade CGBs in a statement, buying short-term CGBs and selling long-term bonds, resulting in a net purchase of 100 billion yuan.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新