Caixin Explains: Why and How China’s Overhauling Monetary Policy (Part 1)

Listen to the full version

China’s central bank is starting a major overhaul of how it manages monetary policy as the country adapts to slowing growth and the changing structure of the economy.

The new framework, which brings the People’s Bank of China (PBOC) more into line with its peers in other major economies including the U.S. and European Union, was flagged by Governor Pan Gongsheng in a speech in June. He also pledged to improve communication with the markets to enhance transparency and guide expectations about the direction of policy.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China's central bank, the PBOC, is overhauling its monetary policy to shift focus from quantitative targets to interest rates, aiming for better market-based regulation.

- Governor Pan Gongsheng highlighted the need to reduce the emphasis on volume and improve the effectiveness of monetary policy amid economic structural changes.

- The PBOC plans to simplify the interest rate system, enhance communication for transparency, and utilize government bonds to manage liquidity.

China's central bank, the People's Bank of China (PBOC), is undergoing a significant reform of its monetary policy framework to better manage the country's economic slowdown and evolving economic structure [para. 1]. Announced by Governor Pan Gongsheng in a June speech, the overhaul aims to bring the PBOC’s operations more in line with other major economies like the U.S. and the EU, and includes three key changes: a shift from quantitative targets to a focus on interest rates, streamlining the current complex interest rate system, and trading government bonds in the secondary market [para. 2][para. 3].

These reforms signify a major shift in monetary policy objectives and tools. According to experts like Xing Zhaopeng, the market impact will be gradual, and Chinese banks will require time to adapt to a more liberalized interest rate system [para. 4]. Lynn Song from ING Bank NV notes that these long-term measures aim to create a more market-based system for interest rate regulation [para. 5].

In a three-part explanation, Caixin notes that part one discusses the reasons behind this shift, part two delves into the changes in the interest rate system, and part three explores the role of government bonds in managing liquidity [para. 6].

The existing framework is not effective because financial institutions are not responding as desired to the PBOC's monetary policy decisions. The central bank manages too many interest rates, often sending mixed signals to the market, exacerbating the issue [para. 7][para. 8].

This reform is an extension of ongoing adjustments. Since the 1990s, the PBOC has been shifting from a centrally planned to a market-based system, adapting from rapid growth to a slower economic pace [para. 10]. Previously, the focus was on quantitative measures like bank lending and M2 money supply. In the mid-2010s, as interest rate liberalization was largely completed, the PBOC began to emphasize borrowing costs [para. 11][para. 12]. However, in 2018, the central bank reduced its reliance on annual quantitative targets, opting for broader policy guidance and benchmark interest rates [para. 14].

But this hybrid system was complex and inadequate for current economic conditions [para. 17]. During China's high-growth era, quantitative measures were essential to meet rising credit demand [para. 18]. However, with current economic growth averaging around 5% from 2019 to 2023, driven more by the services sector rather than manufacturing or construction, the focus needs to shift [para. 20][para. 21][para. 22].

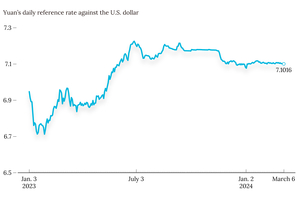

With economic expansion slowing, traditional drivers of credit demand, like the property sector and local government financing, are in decline. Consequently, the PBOC recognizes that pushing more credit is not a viable solution, making lending inefficient and leading to idle money in the financial system [para. 22][para. 23]. Pan Gongsheng emphasized the need to reduce the focus on quantity targets, highlighting interest rates for economic regulation [para. 24].

Monetary aggregates like TSF and M2, essential indicators of money circulating in the economy, are now less significant. These are growing more slowly, reflecting China's changing economic priorities towards "high-quality development" [para. 26]. For instance, outstanding M1 (liquid money supply) fell by 5% year-on-year by the end of June, while M2 grew at a record-low rate of 6.2% [para. 27].

Pan states that the inefficiency of existing loans and outdated metrics for economic indicators hinder effective economic management [para. 30]. The growth of financial services and innovations necessitates updates to the definitions and calculations of these monetary aggregates for accurate economic assessments [para. 31][para. 33].

Overall, these reforms represent a strategic shift towards ensuring more effective and efficient management of China’s monetary policy adapted to the current economic landscape [para. 36].

- Australia and New Zealand Banking Group Ltd.

- Australia and New Zealand Banking Group Ltd. (ANZ) is an international banking and financial services institution. According to the article, Xing Zhaopeng, a senior China strategist at ANZ, commented on China's monetary policy overhaul, stating that the market impact will be gradual and Chinese banks will need time to further liberalize the interest rate system.

- ING Bank NV

- According to the article, Lynn Song is the chief economist for Greater China at ING Bank NV. Lynn notes that the long-term reform measures by the PBOC aim to improve market-based interest rate regulation and provide more flexible tools to influence market rates.

- China International Capital Corp. Ltd.

- China International Capital Corp. Ltd. (CICC) is a leading Chinese investment bank. Analysts at CICC estimated in a June 11 report that if personal demand deposits and highly liquid assets were included in M1, the growth rate of M1 in April would have been approximately 0.6% to 1.1%, instead of the published drop of 1.4%.

- 2010:

- TSF was introduced in China as an indicator to measure financing and liquidity in the financial system.

- In the mid-2010s:

- The liberalization of the interest rate system was largely complete, leading the PBOC to put a greater focus on using the cost of borrowing to allocate credit.

- 2018:

- The central bank dropped some of its annual quantitative targets, including growth in M2 money supply and TSF.

- June 2024:

- Governor Pan Gongsheng flagged the new monetary policy framework in a speech and pledged to improve communication with the markets.

- June 19, 2024:

- Xing Zhaopeng wrote in a report about the gradual market impact of the new framework and said Chinese banks need time to further liberalize the interest rate system.

- As of the end of June 2024:

- Outstanding TSF of 395.1 trillion yuan was 8.1% higher than a year earlier, but the growth rate was a record low.

- As of the end of June 2024:

- Outstanding M1 stood at around 66 trillion yuan, a year-on-year decrease of 5%, while outstanding M2 was up just 6.2%, a record-low growth rate.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新