Tianqi Warns of $670 Million-Plus Loss Over Lithium Price Plunge

Listen to the full version

Chinese lithium giant Tianqi Lithium Corp. (002466.SZ) is forecasting a net loss exceeding $670 million for the first half of the year as plummeting lithium prices hurt the bottom line of producers of this essential battery raw material.

Tianqi said Tuesday that it anticipates a significant net loss of between 4.9 billion yuan and 5.5 billion yuan ($674 million and $756 million) for the six-month period. This includes a projected net loss of between 983 million yuan and 1.6 billion yuan for the second quarter, which is narrower than the 4 billion-yuan loss reported in the first quarter.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Tianqi Lithium Corp. expects a net loss between 4.9 billion yuan and 5.5 billion yuan ($674 million and $756 million) for the first half of the year due to falling lithium prices and high inventories.

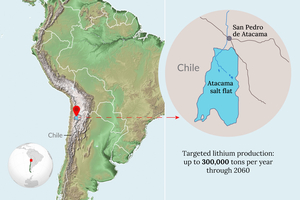

- The company's overseas investments in Australia and Chile have added to its financial woes amid the price collapse, with lithium prices in China down 70% from a year ago.

- Analysts have significantly reduced profit expectations for Tianqi and other Chinese lithium producers like Ganfeng Lithium Group also face sizeable losses.

- Tianqi Lithium Corp.

- Tianqi Lithium Corp. (002466.SZ) is facing a projected net loss of $670 to $756 million for the first half of the year due to plummeting lithium prices, high inventories, and declining returns from overseas investments. The second-quarter loss is expected to be narrower than the first quarter's 4 billion-yuan loss. The company's financial challenges are exacerbated by large debts from aggressive overseas investments in Australia and Chile in the 2010s.

- Ganfeng Lithium Group Co. Ltd.

- Ganfeng Lithium Group Co. Ltd. is also experiencing financial difficulties, forecasting a first-half net loss of between 760 million yuan and 1.25 billion yuan. Despite increased product shipments, the company reported a significant decline in operating performance due to falling lithium prices. Additionally, Ganfeng suffered substantial fair value losses from its stake in Pilbara Minerals, an Australian mining company. Analysts note that Ganfeng's heavy reliance on external procurement of lithium concentrate makes it particularly vulnerable to price fluctuations.

- Pilbara Minerals

- Pilbara Minerals is an Australian mining company in which Ganfeng Lithium Group Co. Ltd. holds a stake. The drop in Pilbara Minerals' share price has led to substantial fair value losses for Ganfeng.

- 2023:

- Lithium prices collapsed by more than 80%.

- May 2024:

- Soochow Securities Co. Ltd. reduced their profit estimate for Tianqi Lithium Corp. from 3.57 billion yuan to 10 million yuan.

- May 2024:

- Huafu Securities Co. Ltd. revised their forecast for Tianqi from a 3.3 billion-yuan net profit to a 939 million-yuan net loss.

- Tuesday, July 9, 2024:

- Tianqi Lithium Corp. announced a forecast of a significant net loss of between 4.9 billion yuan and 5.5 billion yuan for the first half of the year.

- Tuesday, July 9, 2024:

- Tianqi Lithium Corp. reported a net loss forecast of between 983 million yuan and 1.6 billion yuan for the second quarter.

- Tuesday, July 9, 2024:

- Ganfeng Lithium Group Co. Ltd. forecasted a first-half net loss of between 760 million yuan and 1.25 billion yuan.

- Wednesday, July 10, 2024:

- Lithium prices in China stood at 90,500 yuan per ton, down 70% from a year ago.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新