PIIE: China Goes From Strength to Strength in Global Trade

Tianlei Huang is a research fellow at the Peterson Institute for International Economics (PIIE). Nicholas Lardy is a senior research fellow at the PIIE. This article was first published on PIIE’s website.

China’s economy has bounced back since the second quarter of 2020, while the rest of the world is still deep in the Great Lockdown Recession. China’s economic output grew 0.7% in real terms January through September 2020, and it is projected to be the only major economy that will expand in 2020. Despite weak growth in the rest of the world, China’s net exports still grew, contributing 15% of its growth in the first three quarters. Because global trade volume is forecast to fall 10% in 2020, China’s share in global trade will almost surely rise substantially.

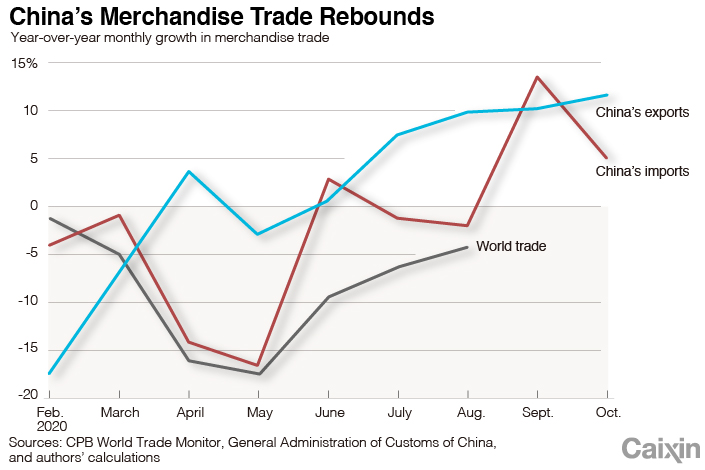

China’s exports are surging despite disruptions. Merchandise exports, after declining in the first quarter, have rebounded since then. As the first chart shows, China’s exports in October rose 11.4% from a year earlier, higher than 9.9% in September and 9.5% in August. Cumulative year-to-date exports through October expanded 0.5%.

|

Global trade also seems to have recovered, though more slowly than China’s trade. The World Trade Organization lately forecast that global merchandise trade in 2020 would fall by 9.2%, while the International Monetary Fund is now projecting a 10.4% decline in world trade volume, including goods and services.

The Latest data from the Chinese customs authority also suggest that global demand for Chinese goods is gradually coming back. Based on year-to-date data, China’s merchandise exports to many of its largest trading partners, including the United States, the European Union, and member states of the Association of Southeast Asian Nations, have grown again in recent months.

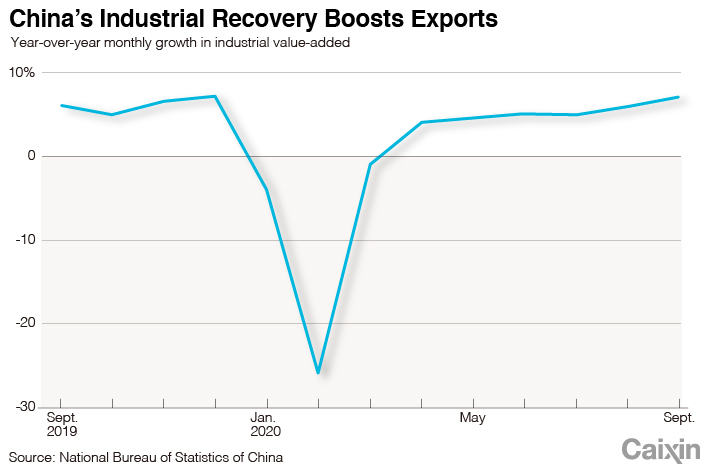

The strong recovery of China’s exports results from, first, the quick recovery of Chinese industry, thanks to China’s success in controlling the spread of the pandemic domestically. Industrial value-added growth picked up quickly after the height of the crisis in the first quarter and has now come back to pre-Covid-19 levels, the second chart shows.

|

In addition, continued discrepancies between supply and demand in many overseas markets have driven the recovery. While Covid-19-related restrictions have been lifted in some places around the world, some countries are still in lockdown mode. Production of goods globally is still running short of demand in these countries. Chinese exporters are actively filling this vacuum. More likely than not, China will continue to go from strength to strength in global trade through at least the end of the year.

But there is also a counterforce, which is China’s appreciating currency. The yuan has strengthened dramatically in recent months and is expected to keep appreciating through at least the end of 2020, making Chinese goods more expensive for their trading partners.

From the beginning of the year to early November, the yuan appreciated about 4% against the dollar; from its low point in late May, the appreciation has been 7%. The appreciation of the yuan has something to do with both the export rebound and the continued influx this year of foreign funds into China’s onshore capital markets, especially the bond market.

China’s imports are also recovering, though slower than exports. Through the end of October, China’s imports dropped 2.3% compared with the same period in 2019. But monthly data reveal signs of a speedy recovery. Imports in September expanded 13.2% year-on-year, followed by a 4.7% increase in October, which makes China on track to reach its pre-Covid-19 import level by the end of 2020.

Meanwhile, China’s imports from the U.S. are rebounding fast, expanding 3.3% year-on-year through October, perhaps in an effort to meet its purchase obligations made in its phase one trade agreement with the U.S. in January. According to the U.S.-China phase one deal tracker by Chad P. Bown, through the first nine months of 2020, Chinese imports from the U.S. of all the goods covered in the phase one deal were only 53 to 54% of their year-to-date targets.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- PODCAST

- MOST POPULAR