Cover Series: How SoftBank’s $11 Billion Bet on Didi Turned Sour (Part 2)

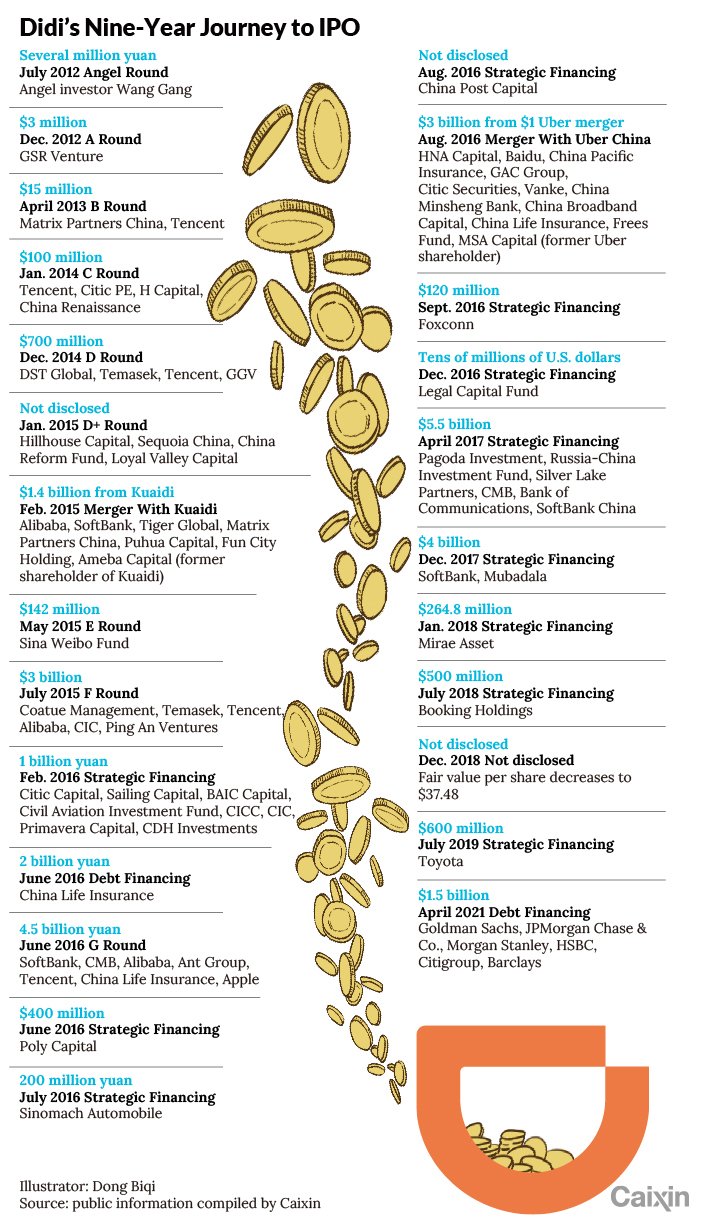

Like many money-losing tech startups, dominant Chinese ride-hailing company Didi Chuxing has relied heavily on private equity financing since its inception in 2012. Through 23 rounds of financing, Didi raised more than $35 billion from nearly 100 investors, valuing the company as high as $62 billion in an August 2020 fundraising round.

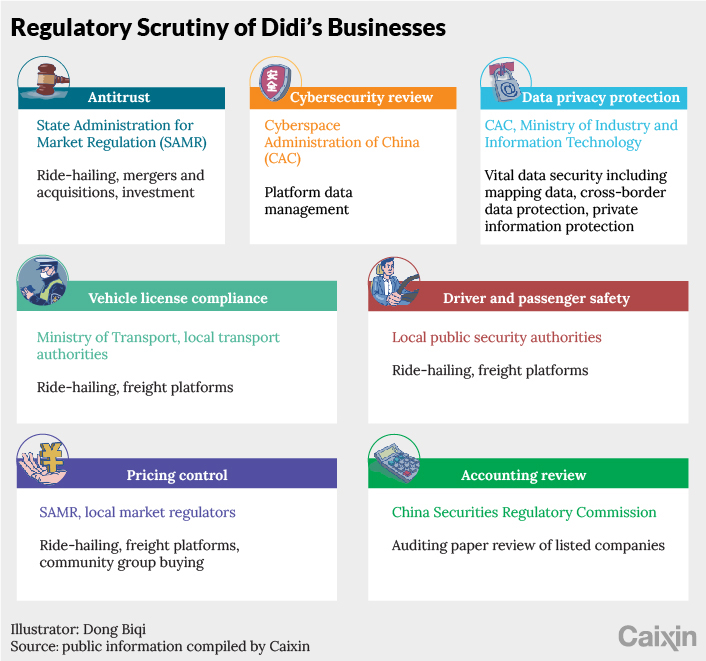

China’s abrupt crackdown on Didi after its $4.4 billion U.S. initial public offering (IPO) June 30 sent its shares plunging, dealing those investors a hard blow, especially its biggest shareholder, Japan’s Softbank Group. SoftBank invested nearly $11 billion in Didi starting in 2015. As of Friday’s close, its stake was worth just around $11.2 billion, making the bet barely profitable.

|

Didi rushed into a U.S. flotation without a blessing from Beijing at least partly because it has been under pressure from shareholders impatient to exit from their investments. It promised them an IPO in fundraising agreements. As some of the early investors were eager to cash out, Didi repurchased around 18.3 million shares from shareholders as of May.

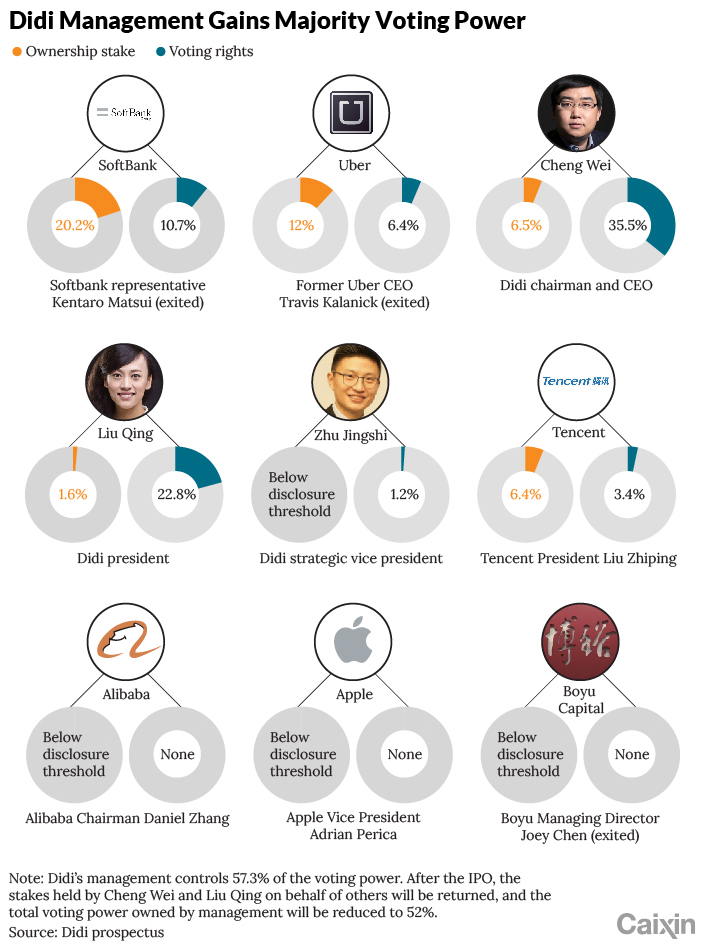

Among Didi’s biggest shareholders, Softbank faces the greatest pressure to cash out. Before the IPO, SoftBank’s Vision Fund held a 21.5% stake in Didi, and its 21.5% voting power exceeded that of Didi’s three founders, Cheng Wei, Liu Qing and Zhu Jingshi.

|

SoftBank, the world’s biggest tech investor, was caught in a debt crisis in 2019 because of poor performance in the public markets of many tech companies in its investment portfolio, especially the aborted IPO of co-working real estate company WeWork, one of SoftBank’s biggest bets.

Didi’s valuation in the private equity market was maxed out, an investor told Caixin in 2018. Its valuation fell dramatically after two cases of rape and murder involving Didi drivers that year triggered a boycott and regulatory pressure over passenger safety. The company’s fair value per share decreased from $41.04 as of July 31, 2018, to $ 37.48 as of Dec. 31, 2018, with a valuation of around $40 billion, according to the IPO prospectus filed in June.

The company originally considered a Hong Kong IPO in mid-2020 but waived that plan amid concerns that it could face harsher regulatory scrutiny in Hong Kong. Although the company has asserted that it had plenty of cash to burn, it never stopped fundraising. Didi’s nearly 100 private equity shareholders are the most for a Chinese internet startup.

In its last pre-IPO fundraising completed Dec. 31, the company’s fair value per share increased to $42.08 from $37.65 as of July 29, according to the prospectus. Besides a business recovery from the pandemic, the higher valuation mainly reflected its pledge to shareholders of a successful IPO.

Just before the company filed its confidential IPO with the U.S. Securities and Exchange Commission in mid-April, Didi raised $1.5 billion in debt financing from investment banks including JPMorgan Chase & Co., Morgan Stanley, Goldman Sachs Group Inc., HSBC Holdings Plc, Barclays Plc and Citigroup Inc., Bloomberg reported, citing sources familiar with the matter. JPMorgan, Morgan Stanley and Goldman Sachs were also underwriters for Didi’s IPO.

Besides its core ride-hailing business, Didi’s various new businesses have also attracted private equity investors. The autonomous driving subsidiary raised $300 million in a funding round led by IDG Capital earlier this year, following a fundraising round of $525 million last year.

Almost every round of Didi fundraising included convertible securities. As of March 31, its total of convertible redeemable preferred shares were valued at $30.7 billion. On the maturity date, shareholders can choose to convert such shares into common stock or debt. If they choose not to do so, Didi is obligated to redeem the shares for cash.

|

Pressure on SoftBank

SoftBank posted a record net loss of 962 billion yen ($8.73 billion) in fiscal 2019 after writing off huge investment losses in more than 20 other companies, including Uber and WeWork. It made a dramatic turnaround in fiscal 2020 to $46 billion of profits, boosted by $8 billion increase in the valuation of its holdings in U.S. ride-hailing service operator Uber Technologies Inc., which holds a 12.8% stake in Didi. This year, Softbank needs another Uber.

In addition to its investment in Didi’s parent company, SoftBank has also poured funds into Didi’s new businesses. In February, Softbank and others invested $900 million in Didi’s community group buying business, Chengxin Technology Inc., and received preferred shares issued by Chengxin, according to the Didi prospectus. In 2020, Softbank participated in a $134 million investment in Didi’s bike sharing business, Soda Technology Inc. Softbank also led an investment of $340 million in Didi’s autonomous-vehicle subsidiary, Voyager Group Inc.

In all of these investments, Softbank received preferred shares from the units. As part of the agreements, Didi promised that it would buy back preferred shares with cash or convert them to Didi parent company equity if Chengxin and Soda failed to complete IPOs in five years. If Didi needs to pay large sums of cash to buy back those preferred shares, that would “materially” hurt its liquidity and financial conditions, Didi said in the prospectus.

As liquidity in the U.S. stock market is expected to tighten by the third quarter this year, both investors and companies hope to complete IPOs as soon as possible at relatively high market values, the head of a large U.S. private equity fund said.

In the first half of 2021, 34 Chinese companies raised a record $12.5 billion in U.S. IPOs. There are as many as 34 pending filings for U.S. listings by companies based in China or Hong Kong, according to Bloomberg.

To clear the way for Didi to sell publicly traded shares, Softbank gave up its board seat and returned to its position as only a financial investor. Chinese regulators have raised concerns about large foreign ownership of Chinese companies. As China’s dominant ride-hailing provider, Didi owns a large amount of data on the country’s urban transportation and users. That means it’s necessary to ensure that foreign shareholders such as SoftBank and Uber can’t get access to the data, a person at a financial intermediary said.

Following the IPO, Softbank’s voting power fell by half to 10.7% while the founders and management gained more voting power. Co-founder and Chief Executive Cheng holds a 6.5% stake, and co-founder and President Liu holds 1.6%. In the second quarter, Didi began to accelerate the implementation of equity incentive plans for management and executives, resulting in share-based compensation expenses of $3.03 billion. After the IPO, Cheng, Liu and Zhu together hold about 10%, but collectively they have 52% of voting rights. All three became board members with the power to appoint or remove executive directors and nominate top executives, according to the prospectus.

Softbank and Uber, the second-largest shareholder, don’t have board seats at Didi, forming a structure in which board representation is completely out of proportion with shareholders’ stakes. The interests of Didi’s directors and executives may conflict with those of shareholders on certain matters, which may leave shareholders at a disadvantage, the prospectus said.

This is the second in a series of stories about the regulatory storm that followed Didi's IPO. Click to read part one, part three and part four.

Contact reporter Denise Jia (huijuanjia@caixin.com) and editor Bob Simison (bobsimison@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR