In Depth: China’s Takeout Wars — Is Meituan Set to Eat Alibaba’s Lunch?

Editor’s Note: This story is the first of a two-part series on Alibaba’s efforts to defend itself from younger rivals. Read part two here.

A year after Alibaba began a new chapter with the departure of founder Jack Ma, the e-commerce giant has found little time for rest as two of its biggest businesses face fresh assaults from younger rivals with ambitious leaders who look much like Ma in his early days.

Among those, Meituan Dianping has emerged as the largest threat to Alibaba’s ambitions in local lifestyle services, with the two companies’ core takeout dining businesses at the center of the battle. Alibaba has fallen dangerously behind in the war over the last two years, mostly due to its newness in the space.

Meituan Dianping began life as a Chinese imitator of U.S. group buying sensation Groupon, and later cobbled together a series of online-to-offline (O2O) offerings with a common theme of letting local businesses use its digital services to sell things like meals and movie tickets to consumers. The crown jewel in its offerings is its takeout dining service, whose thousands of drivers now deliver other products like groceries as well.

By comparison, Alibaba only formed its local lifestyle products group last year, centered on its Ele.me takeout dining unit that was once an industry leader but has stumbled in the face of Meituan’s challenge. The new Alibaba division also includes its chain of brick-and-mortar Freshippo supermarkets, along with some other traditional retail assets and its bike sharing service.

Alibaba’s traditional strength has been in online operations without a geographic focus, such as attracting investment, inventory management and major promotions, Wang Lei, who now heads Ele.me as its CEO, told Caixin in a recent interview. But it still needs to perfect its game at offering the kinds of localized services where Meituan has found a niche.

“Meituan has been a locally-focused organization for 10 years,” he said. “It’s the hardest of businesses. If it can last in the space that long, that’s quite a formidable fortress to break through,” Wang said.

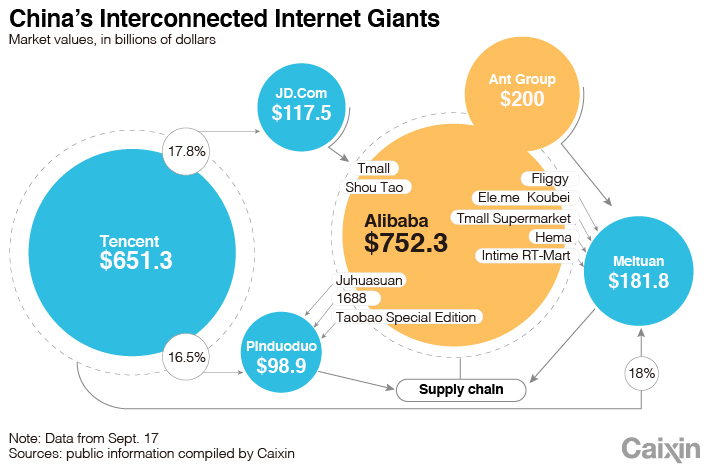

The two companies’ stocks act as a proxy of sorts for how investors see the rivalry. Alibaba’s shares have risen about 60% in the past year, giving the company a market value of about $780 billion. But Meituan’s have more than tripled over that time to their current level, giving it a market value of about $200 billion.

Major adjustments

Whereas Meituan has been fine-tuning its game over the last decade, Alibaba’s move into the space has been more turbulent and concentrated in the past two years. It first purchased a stake in Ele.me in 2016 after falling out with Meituan, in which it had also made an early investment. A year later Ele.me appeared headed for a market leading position when it purchased the takeout delivery business of online search giant Baidu, reducing the market to two major players from the previous three.

Alibaba would go on to buy the rest of Ele.me in 2018, in a deal that valued the entire company at $9.5 billion. But the transition saw the departure of Ele.me’s founder and much of its senior management team, leaving behind an army of less experienced “student soldiers.” Lacking an experienced person to run the show, Jack Ma replacement and current Alibaba CEO Daniel Zhang bought in Alibaba veteran Wang a year ago to revive the unit by trying to integrate it better with the rest of Alibaba.

“It’s been like changing engines while the plane is flying,” Wang told Caixin, describing the past year. Despite offering nonstop subsidies last year and attempting to build up its business in smaller cities through agent agreements, Ele.me’s share of the overall market has remained relatively constant, with about three Ele.me customers to every seven for Meituan.

|

Alibaba took its most decisive step in the second half of last year when it formally set up the local lifestyle unit, combining Ele.me with other pieces like brick-and-mortar supermarkets, shared bicycles and travel services. As was the case with Ele.me, company veteran Hu Xiaoming, president of Alibaba’s Ant Group financial affiliate, was brought in to head up the new group.

In a sign that the better-focused Alibaba may be preparing to follow a similar tack to Meituan, Ele.me in July unveiled a new version of its app that included an expansion offering other local services beyond its core takeout dining. “New additions will only move in this direction. They won’t be in the food and beverage space,” a source close to Ele.me told Caixin.

While Alibaba was struggling for direction with the new unit, Meituan suffered its own setback earlier this year as demand for its takeout dining services surged during the pandemic. Despite that surge, many of Meituan’s restaurant partners – whose in-store dining business plummeted – rose up against the company for its high commissions and forced exclusivity agreements.

Meituan ultimately conceded by lowering its commission rates and releasing restaurants from exclusive agreements. Those goodwill moves, albeit made largely out of necessity, turned the uprising and subsequent settlement into a positive force for Meituan and helped it to further consolidate its position as takeout delivery leader, again at Alibaba’s expense.

Integrating the pieces

Meituan’s early focus on localized lifestyle services gradually saw it group most of those into a single app, which conveniently exposed users of one service to others in its lineup. Meituan CEO Wang Xing has made it known that his goal is to leverage the high volume passing through his company’s app to process 100 million orders per day for its wide range of services. To reach that goal he has moved into a growing number of areas that increasingly encroach on Alibaba’s traditional e-commerce, including Meituan’s latest move into fresh produce and grocery sales.

Alibaba has yet to roll out an integrated offering like Meituan’s for its local lifestyle business, though it is making more integration efforts in general. For example, Ele.me has achieved integration with a sister brand supermarket operator in the same local lifestyle group, so that goods ordered through the former are now actually supplied by the latter.

Perhaps most strategically in that regard, Alibaba is hoping to leverage the huge power of Alipay, the hugely popular electronic payments platform owned by its Ant Group financial affiliate. Alipay has helped to drive more users to the local lifestyle group by raising the group’s services to higher positions on its own menu of in-app products and services.

In this year’s second quarter, some 45% of the local lifestyle division’s new users came through such introductions. “This proportion has been pretty stable, showing that users have already developed this habit,” Wang said.

At the same time, Alibaba is currently making concerted efforts to clearly distinguish between suppliers and logisitics providers involved in more traditional non-geographic-specific e-commerce, and its newer generation of local lifestyle functions focused on services within a 3.5 kilometer radius. Such closer proximity services were an unfamiliar area for Alibaba due to its relative lack of assets and relationships focused on providing such services.

“Daniel Zhang started focusing on these local life services from 2019, and it has become one of his most important areas,” said a person close to Zhang. “You could call it Alibaba’s ‘No. 1 work in progress’.”

Contact reporter Yang Ge (geyang@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR