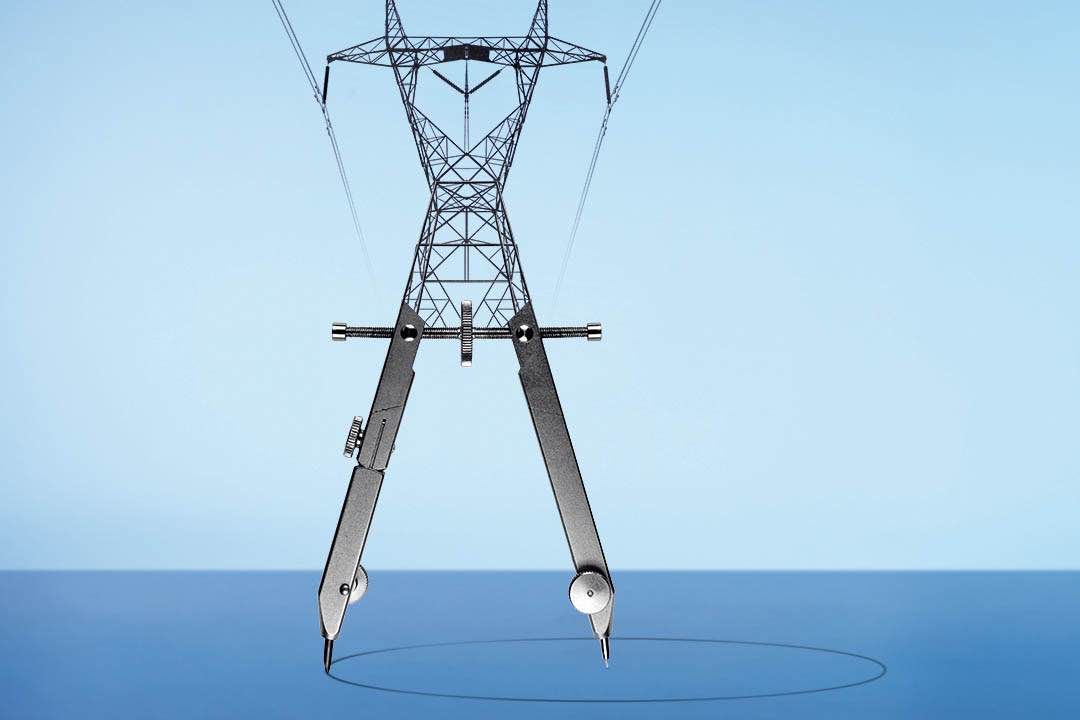

Cover Story: China’s Power Market Reform Poised to Level Up as Renewables Plug In

Listen to the full version

China’s two-decade long campaign to reform its power sector to ensure a stable supply of electricity nationwide, mostly with fossil-fuel fired stations, while also meeting carbon reduction goals with renewables appears to be at something of a crossroads.

The key to achieving the reform goals — providing a balanced, secure, clean, and affordable energy mix — lies with integrating new energy generation capacity like solar, which has seen explosive growth in terms of installed capacity in recent years, into the national grid and a market-based power trading system.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China is balancing fossil fuels and renewable energy for its electricity needs, facing challenges with integrating new energy like solar and wind due to supply fluctuations.

- Despite a large installed capacity, renewable energy's contribution to actual generation remains low (solar <5%, wind just over 10%), complicating market integration.

- Reforms are ongoing to develop a unified power market by 2030, aiming to improve efficiency, integrate renewables better, and address cost and supply issues.

China has been on a two-decade-long campaign to reform its power sector to ensure a stable nationwide electricity supply, predominantly using fossil fuels, while simultaneously working towards carbon reduction goals through renewables.[para. 1] The main objective is to balance, secure, clean, and provide an affordable energy mix by integrating growing capacities of solar energy and other renewables into the national grid and power trading system.[para. 2] Despite initial success with lifting state-set power pricing, new energy providers face difficulties in market participation due to supply fluctuations, presenting a significant challenge for policymakers.[para. 3]

The imbalance between traditional coal-fired generators and new energy providers has significant consequences for China’s electricity grid, which is critical for the country's economic growth.[para. 4] While coal still constitutes about 60% of China's electricity, renewables have grown considerably, reaching an installed capacity of 1,600 gigawatts (GW) by May, a 30% year-on-year increase now making up over half of the total installed capacity.[para. 5] However, actual generation from key renewables is much lower, with solar providing less than 5% and wind just over 10% of the nation's total. Increasing these levels remains a major policy challenge.[para. 6]

China’s new energy capacity boom has been driven by state-set on-grid prices and guaranteed power purchases to meet carbon reduction targets. The combined wind and solar power capacity surpassed 1,130 GW by April, likely meeting the target of 1,200 GW by the end of 2024, six years ahead of schedule.[para. 7] Nonetheless, post the 2015 reforms, the government relaxed control over power generation and sales, retaining control over the grid.[para. 10] Easing mandatory purchase requirements for grid companies to buy new energy sources further complicates policy goals, as fluctuating new energy supplies challenge stable grid integration.[para. 12] Solar and wind energy's intermittent supply can lead to both excess and shortage in various regions despite installed capacity.[para. 13]

For instance, solar power peaks at noon, causing system operation complexities and significant power production costs due to its fluctuations.[para. 14] Market prices for new energy have tumbled in some regions like Gansu, impacting company revenues and highlighting the high costs despite decreasing generation costs.[15,16] The disparity between installed capacity and actual generation is stark, with solar accounting for 21% of total installed power capacity but only 3% of total generation, reflecting low utilization rates.[para. 18] This situation exemplifies the difficulty of balancing stable power supply, new energy development, and cost management.[para. 22]

China needs to reform its pricing systems, originally designed for fossil fuels, to accommodate the intermittent nature of solar and wind power.[para. 23] The IMF emphasized the urgency of developing robust power markets to improve resource allocation and correct market distortions.[para. 24] Chinese authorities aim to create a unified national power market system, expected to be initially completed by 2025 and fundamentally by 2030, to support multi-layered, varied market types.[34,35]

Emphasis is placed on developing spot markets and encouraging renewables in trading to form accurate pricing mechanisms.[para. 37] Despite challenges, progress is evident as the share of new energy traded on the power market increased from 22% in 2021 to 47% in 2023, with aims for full market trading by 2030.[42,43] As the market evolves, more effective pricing signals are crucial to reflecting supply and demand accurately.[45,46]

- Datang International Power Generation Co. Ltd.

- Datang International Power Generation Co. Ltd., represented by Zhao Kebin, former power trading chief of its Gansu unit, highlights challenges new energy providers face in China's power sector. Zhao noted that most solar power generators in Gansu's Hexi region experienced losses due to price fluctuations in the spot market in April and May, reflecting the volatility and high costs of integrating new energy sources into the grid.

- April 2024:

- The combined capacity of wind and solar power exceeded 1,130 GW.

- April and May 2024:

- Most solar power generators in the Hexi region of Northwest China’s Gansu province were stung by a price plunge in the spot market, causing some companies to book losses.

- By the end of May 2024:

- The installed capacity of new energy generation in China reached about 1,600 GW.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新