China to Kick Off Issuance of $138 Billion Ultra-Long Bonds to Boost Economy

Listen to the full version

China will issue the first batch of a planned 1 trillion yuan ($138 billion) of ultra-long special treasury bonds for 2024 starting Friday, as policymakers increase spending on infrastructure projects to support economic growth.

A series of 20-year, 30-year and 50-year special treasury bonds will be issued from May 17 until Nov. 15, according to a schedule released by the Ministry of Finance on Monday, although no details of the value of the individual issuances were provided.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China will begin issuing the first batch of a planned 1 trillion yuan in ultra-long special treasury bonds from May 17 to November 15, 2024, to fund major infrastructure projects and support economic growth. The bonds, spanning 20-year, 30-year, and 50-year terms, aim to address funding shortages for national development goals.

- Half of the bond proceeds will be managed by the central government and the remainder distributed to local governments. The funds are designated for initiatives like scientific self-reliance and regional development.

- Additional monetary easing measures, including cuts in banks' reserve requirement ratios, are anticipated to facilitate these issuances and stimulate broader economic growth amidst challenges like a property market slump and constrained local government spending due to new debt issuance curbs.

China is set to launch the initial phase of a significant financial initiative involving the issuance of 1 trillion yuan ($138 billion) in ultra-long special treasury bonds, starting from May 17 through November 15, 2024. This move is part of a broader strategy to bolster economic growth through increased infrastructure spending [para. 1][para. 2]. Premier Li Qiang announced this multi-year bond issuance program during the National People’s Congress in March, highlighting that the funds will be directed towards major national projects without affecting the official budget deficit [para. 3].

The distribution plan for these funds includes allocating half of the proceeds to central government initiatives and the other half to local governments. These investments will focus on key areas such as scientific and technological independence, urban-rural integration, regional development coordination, and enhancing food and energy security [para. 4][para. 5].

In response to these developments, financial experts anticipate further monetary easing measures by policymakers to ensure successful bond issuances. These may include reductions in banks' reserve requirement ratios aimed at increasing broad money supply and stimulating economic activity [para. 6].

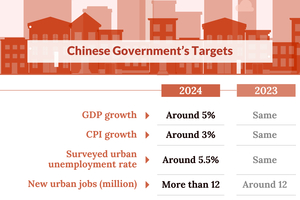

Despite these efforts, China faces ongoing economic challenges including a persistent slump in the property market and weak consumer spending. The economy grew by 5.2% last year but achieving this year's target of approximately 5% GDP growth remains uncertain [para. 7]. Additionally, local governments might find their capacity for infrastructure investment curtailed due to recent measures aimed at reducing undisclosed borrowing practices [para. 8].

The detailed schedule for bond issuance includes multiple installments spread across different maturity periods: 20-year bonds will be issued monthly from May to November; 30-year bonds will see twelve installments starting from May 17; and three installments are planned for the 50-year bonds beginning on June 14 [para. 9]. This structured approach underscores China's commitment to long-term fiscal planning and economic stability.

Moreover, there is an expectation of increased government bond issuance in coming months following a notably slow start earlier in the year. This ramp-up includes not only these special ultra-long bonds but also a catch-up in local government bond issuances which have significantly lagged behind previous years’ figures despite wider budget deficits at local levels [para. 10].

Overall, China’s strategic deployment of ultra-long treasury bonds represents a pivotal effort to finance critical national projects while managing fiscal health amidst challenging economic conditions.

- Standard Chartered Bank

- Standard Chartered Bank's head of China macro strategy, Becky Liu, commented on the expected monetary easing measures by policymakers to support the issuance of ultra-long special treasury bonds in China. These measures may include a cut in banks' reserve requirement ratio to boost broad money supply growth.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新