Big China Tech’s Coronavirus Growth Momentum Carries Over Into Second Quarter

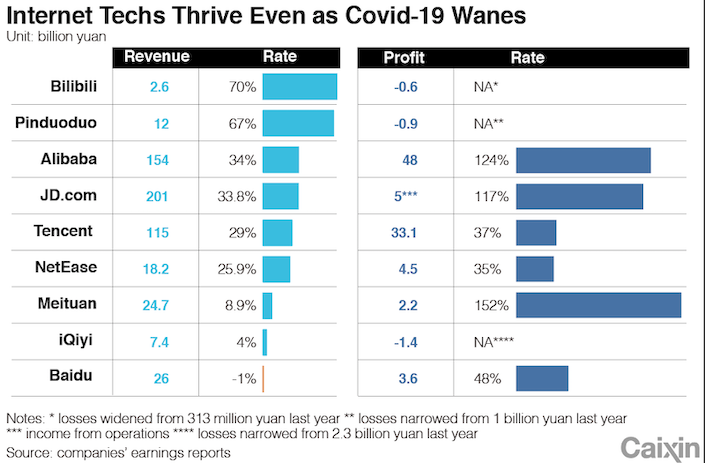

China’s internet sector has seen the momentum built up in the first three months of 2020, when many in the country were confined to their homes, continue into the second quarter even as the domestic epidemic has basically been brought under control.

|

| 3 |

In the first quarter of this year, despite a broader economic slowdown amid the Covid-19 outbreak, internet companies managed substantial growth, especially those providing services such as e-commerce and gaming.

In second quarter, the country’s established e-commerce giants — Alibaba Group Holding Ltd. and JD.com Inc. — reported sales growth of 34% and 33.8% respectively, while challenger Pinduoduo Inc. saw a 67% expansion. For sector leader Alibaba, that growth rate was down from last year, when revenue went up 42%.

Founded in 2015, Pinduoduo was a latecomer to China’s e-commerce race but has since developed at lightning speed by offering steep discounts to lure buyers. During the second quarter, the company has continued to burn through investors’ cash, reporting a net loss of 899 million yuan ($130 million).

In gaming, the country’s top two companies — Tencent Holdings Ltd. and NetEase — both reported more than 20% revenue growth. Tencent got a boost thanks to sales of its mobile games such as “Peacekeeper Elite” and “Honour of Kings,” which helped to offset sales losses from its PC gaming business. The company saw revenue as a whole grow 28%, an increase from last year’s 21% expansion.

Meituan Dianping, China’s largest online-to-offline services provider, swung back to a 2.2 billion yuan profit in the second quarter after reporting a 1.6 billion yuan first quarter loss. The company got a boost due to a pick-up in demand for its hotel bookings and advertising businesses.

The revival of advertising, which slowed considerably in the first quarter, also helped internet search giant Baidu Inc., which makes the majority of its revenue from advertising. The company reported that profit grew 48%, even as revenue declined 1%.

Contact reporter Mo Yelin (yelinmo@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- PODCAST

- MOST POPULAR